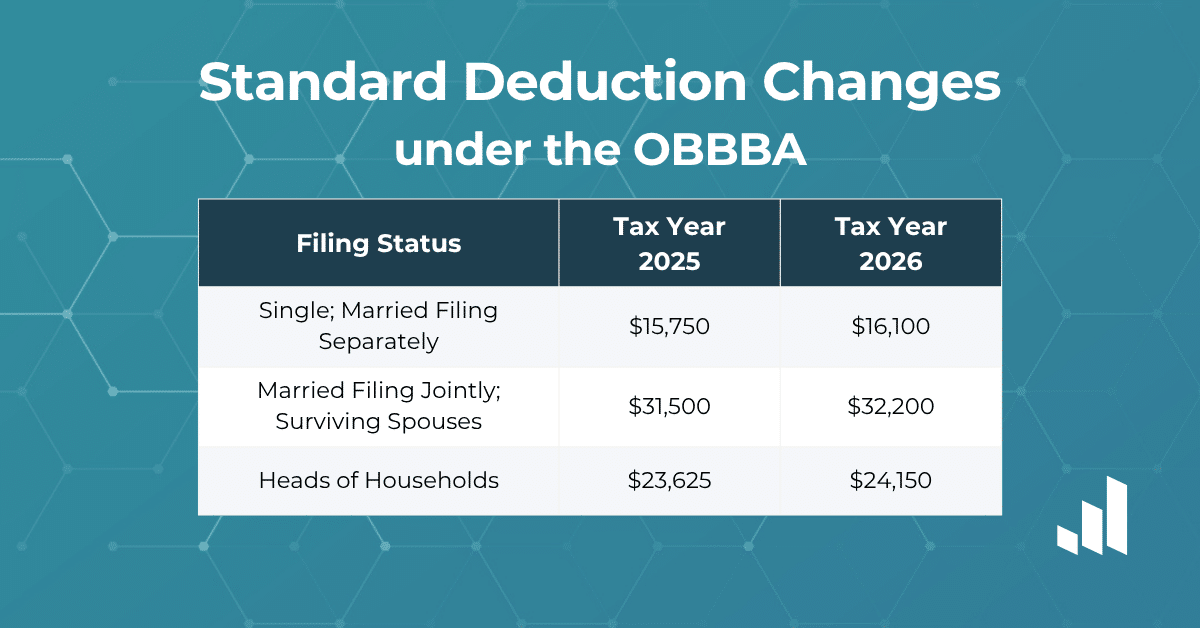

The IRS has released the 2026 tax brackets and inflation adjustments, reflecting significant changes under the One Big Beautiful Bill (OBBBA). From increased standard deductions to enhanced employer tax credits and estate exclusions, these updates will impact how individuals and businesses prepare for the 2026 tax year. Here's a breakdown of what changed—and what didn't.

Displaying: Tax Reform

Surgent CPE Announces First-to-Market CPE Webinars Covering One Big Beautiful Bill Act (OBBBA) Tax Reform

Industry-leading courses provide timely analysis of major new tax law for accounting and finance professionals RADNOR, Pa. (July 3, 2025) — Surgent CPE, a recognized leader in continuing professional education for accounting and finance professionals, announced today the immediate availability of two new CPE webinars providing in-depth coverage of the One Big Beautiful Bill Act […]

Navigating the SALT Landscape: What CPAs Need to Know for 2025

As the December 31, 2025 expiration date for key provisions of the Tax Cuts and Jobs Act (TCJA) approaches, CPAs face increasing questions from clients about the State and Local Tax (SALT) deduction cap and its implications. This blog explores the current SALT landscape, potential changes on the horizon, and strategic considerations CPAs should be […]

The No Tax on Tips Act: What This Means for Workers and CPAs

What Is the No Tax on Tips Act? The No Tax on Tips Act is a significant piece of tax legislation that recently passed unanimously in the Senate and is now headed to the House of Representatives. If enacted, this bill would create a federal income tax deduction of up to $25,000 annually for qualified […]

Surgent course helps tax professionals conquer Inflation Reduction Act

Surgent’s first-to-market CPE course covers the IRA’s new tax provisions in detail, equipping participants to properly advise their individual and business clients if and how the tax changes impact their tax planning.

Build Back Better Act Could Rebound in Congress

Is the Build Back Better Act (BBB) going on a diet? President Biden’s $2.2 trillion spending proposal is showing signs that it’s too big to squeeze through the doors of the U.S. Senate, but advocates believe that losing a few pounds – er, dollars – is just what it needs to win final approval. The […]

Latest on Billionaire’s Tax

Well, the Dems intend to partially fund the upcoming legislation with a wealth tax on roughly 750 Americans. The plan, released this morning, calls for the tax to apply to gains every year, instead of only at sale, to a taxpayer with $1B in assets or a taxpayer who earned $100M in income for three […]

The Current Thinking on Student Loan Repayment – Relief or Windfall?

The IRS recently announced it was expanding aid to taxpayers indebted to federal or private student loans for attendance at both non-profit and for-profit schools. Rev Proc 2020-11 issued January 15, 2020, and it provides safe harbor relief against income recognition after loan discharge for the following three specific situations. Any taxpayer whose private student […]

Final QOZ Regs Provide Guidance to Taxpayers

By: Rachel Parsia, CPA and Nick Spoltore, Esq. It is that dreaded time of the year. The holidays are over. No longer is it socially acceptable to wake up and eat a plate of candy and cookies for breakfast. Even worse, busy season is looming just around the corner. But fear not, there is one […]

SECURE Act Included in Year-End Spending Package

After months of stalled progress in the Senate, Congress passed the Setting Every Community Up for Retirement Enhancement Act (“SECURE” Act). This bill was attached to H.R. 1865, the “Further Consolidated Appropriations Act, 2020,” a $1.4 trillion year-end spending bill that funds the Federal Government through September 30, 2020. President Trump signed the bill into […]