New courses equip CPAs, accountants and tax practitioners with practical, real-world skills for integrating agentic artificial intelligence into daily workflows RADNOR, Pa. (Nov. 24, 2025) — Surgent CPE, a division of KnowFully Learning Group, today announced the launch of its new Agentic AI Certificate Series, a first-to-market, on-demand CPE certificate program designed to help accounting, […]

Displaying: Recent Posts

How Technology Is Transforming Accounting in 2025

Accounting technology now goes far beyond spreadsheets. Finance professionals work with interconnected systems including cloud platforms, artificial intelligence, blockchain networks, and cybersecurity tools that fundamentally change how organizations record transactions, manage risk, and deliver insights to stakeholders. The Public Company Accounting Oversight Board moved away from “technology-neutral” oversight in 2025, creating frameworks specifically for technology-based […]

Surgent Celebrates International Accounting Day 2025 With Week-Long Events and Expert-Led CPE Conference

Virtual sessions during International Accounting Week explore artificial intelligence, audit quality management and OBBBA tax reform, culminating with a free CPA Mock Exam RADNOR, Pa. (Oct. 30, 2025) — Surgent Accounting & Financial Education, a division of KnowFully Learning Group, announced a week-long celebration of International Accounting Day 2025, to be held Nov. 10–14. The […]

10 Study Tips to Maximize Your CPA CPE

CPAs face a consistent challenge: completing continuing professional education requirements while managing client work and personal commitments. The approach matters as much as the time invested. These strategies help CPAs integrate CPE into existing workflows, leverage emerging technologies, and maintain compliance without sacrificing productivity. Build a Realistic CPE Schedule Block CPE hours during naturally slower […]

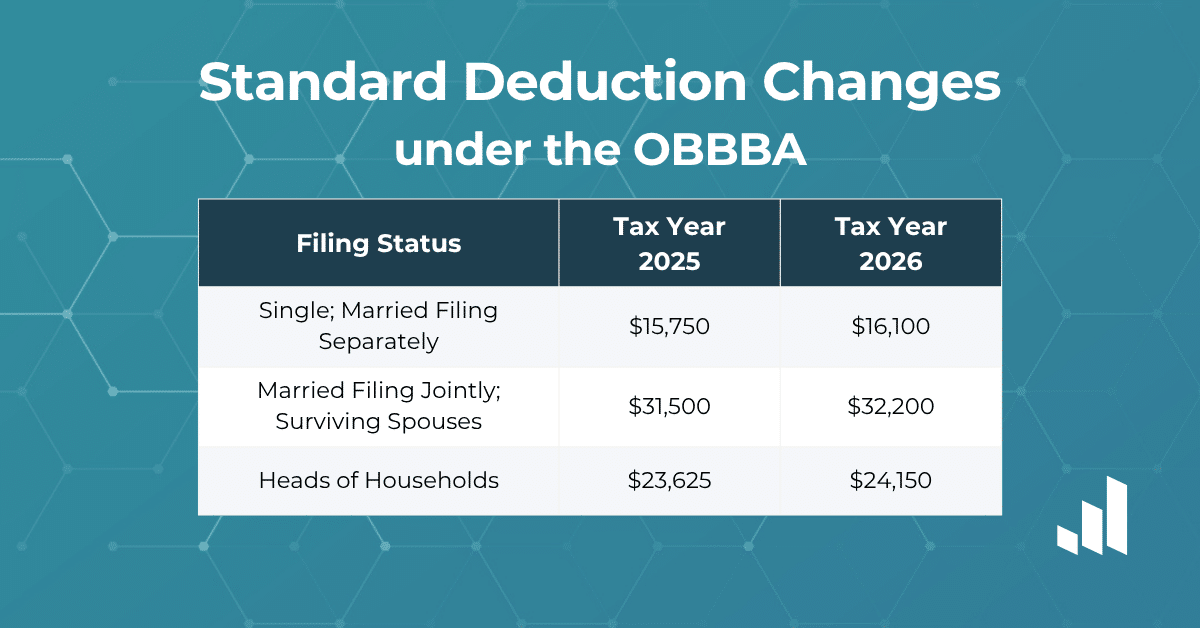

2026 Tax Brackets & Adjustments: What Changed

The IRS has released the 2026 tax brackets and inflation adjustments, reflecting significant changes under the One Big Beautiful Bill (OBBBA). From increased standard deductions to enhanced employer tax credits and estate exclusions, these updates will impact how individuals and businesses prepare for the 2026 tax year. Here's a breakdown of what changed—and what didn't.

Surgent CPE Announces First-to-Market CPE Webinars Covering One Big Beautiful Bill Act (OBBBA) Tax Reform

Industry-leading courses provide timely analysis of major new tax law for accounting and finance professionals RADNOR, Pa. (July 3, 2025) — Surgent CPE, a recognized leader in continuing professional education for accounting and finance professionals, announced today the immediate availability of two new CPE webinars providing in-depth coverage of the One Big Beautiful Bill Act […]

Navigating the SALT Landscape: What CPAs Need to Know for 2025

As the December 31, 2025 expiration date for key provisions of the Tax Cuts and Jobs Act (TCJA) approaches, CPAs face increasing questions from clients about the State and Local Tax (SALT) deduction cap and its implications. This blog explores the current SALT landscape, potential changes on the horizon, and strategic considerations CPAs should be […]

The No Tax on Tips Act: What This Means for Workers and CPAs

What Is the No Tax on Tips Act? The No Tax on Tips Act is a significant piece of tax legislation that recently passed unanimously in the Senate and is now headed to the House of Representatives. If enacted, this bill would create a federal income tax deduction of up to $25,000 annually for qualified […]

Surgent Unveils New Lineup of Continuing Professional Education (CPE) Courses on CPA Day 2025

New courses cover AI, taxation, cybersecurity and more, helping professionals stay current and meet CPE requirements. RADNOR, Pa. (April 16, 2025) — Surgent CPE, a leader in continuing professional education for accounting and finance professionals, on April 16 — in celebration of CPA Day — announced the launch of nearly 50 new CPE courses as […]