The IRS released Revenue Procedure 2025-32 on October 9, 2025, detailing tax year 2026 adjustments that affect returns filed in 2027. With amendments from the One Big Beautiful Bill Act (OBBBA) now in effect, here’s your essential guide to what’s different.

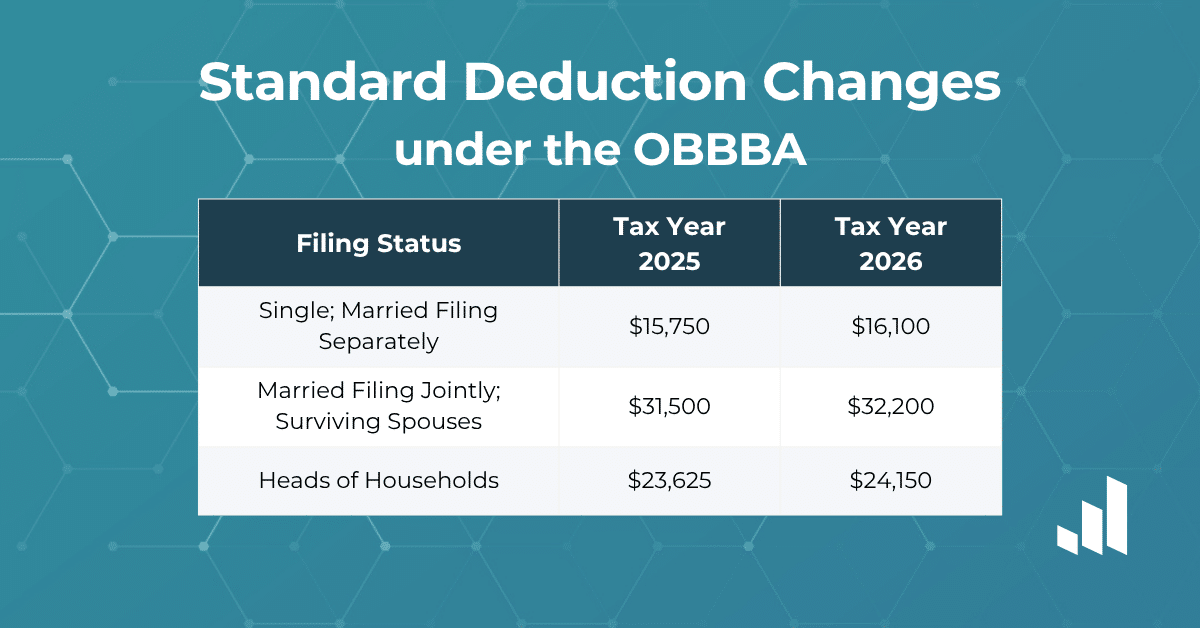

Standard Deductions: 2025 vs. 2026

| Filing Status | Tax Year 2025 | Tax Year 2026 |

|---|---|---|

| Single; Married Filing Separately | $15,750 | $16,100 |

| Married Filing Jointly; Surviving Spouses | $31,500 | $32,200 |

| Heads of Households | $23,625 | $24,150 |

Tax Brackets for 2026

| Single Filers | Married Filing Jointly |

|---|---|

| 37% on income over $640,600 | 37% on income over $768,700 |

| 35% on income over $256,225 | 35% on income over $512,450 |

| 32% on income over $201,775 | 32% on income over $403,550 |

| 24% on income over $105,700 | 24% on income over $211,400 |

| 22% on income over $50,400 | 22% on income over $100,800 |

| 12% on income over $12,400 | 12% on income over $24,800 |

| 10% on income up to $12,400 | 10% on income up to $24,800 |

Alternative Minimum Tax

AMT exemptions for 2026:

- Single: $90,100 (phase-out begins at $500,000)

- Married Filing Jointly: $140,200 (phase-out begins at $1,000,000)

Estate Planning: Major Increase

The basic exclusion amount increases to $15,000,000 for decedents who die during 2026, up from $13,990,000 in 2025. This represents a $1,010,000 increase.

The annual gift exclusion holds at $19,000. Gifts to non-citizen spouses increase to $194,000, up $4,000 from 2025.

Employer Benefits: Significant Expansion

Childcare Tax Credit Increases

OBBBA increased the employer-provided childcare tax credit from $150,000 to $500,000 ($600,000 for eligible small businesses).

Other Benefit Adjustments:

- Qualified transportation/parking benefit: $340/month (up $15)

- Health FSA contribution limit: $3,400 (up $100)

- Health FSA carryover maximum: $680 (up $20)

Credits and Exclusions

Earned Income Tax Credit: Maximum $8,231 for taxpayers with three or more qualifying children (up from $8,046)

Foreign Earned Income Exclusion: $132,900 (up from $130,000)

Adoption Credit: $17,670 maximum (up from $17,280), with $5,120 refundable

What Didn’t Change

Personal exemptions remain at zero. The limitation on itemized deductions stays eliminated, though OBBBA imposes a limitation on tax benefits for the 37% bracket. Lifetime Learning Credit phase-outs remain at $80,000-$90,000 (single) and $160,000-$180,000 (joint).

For complete details visit the IRS website.

Learn More About OBBBA Tax Changes

Want to go deeper into the tax law updates from the One Big Beautiful Bill Act? Explore our One Big Beautiful Bill Act Premium CPE Series.