Virtual sessions during International Accounting Week explore artificial intelligence, audit quality management and OBBBA tax reform, culminating with a free CPA Mock Exam RADNOR, Pa. (Oct. 30, 2025) — Surgent Accounting & Financial Education, a division of KnowFully Learning Group, announced a week-long celebration of International Accounting Day 2025, to be held Nov. 10–14. The […]

Displaying: October 2025

10 Study Tips to Maximize Your CPA CPE

CPAs face a consistent challenge: completing continuing professional education requirements while managing client work and personal commitments. The approach matters as much as the time invested. These strategies help CPAs integrate CPE into existing workflows, leverage emerging technologies, and maintain compliance without sacrificing productivity. Build a Realistic CPE Schedule Block CPE hours during naturally slower […]

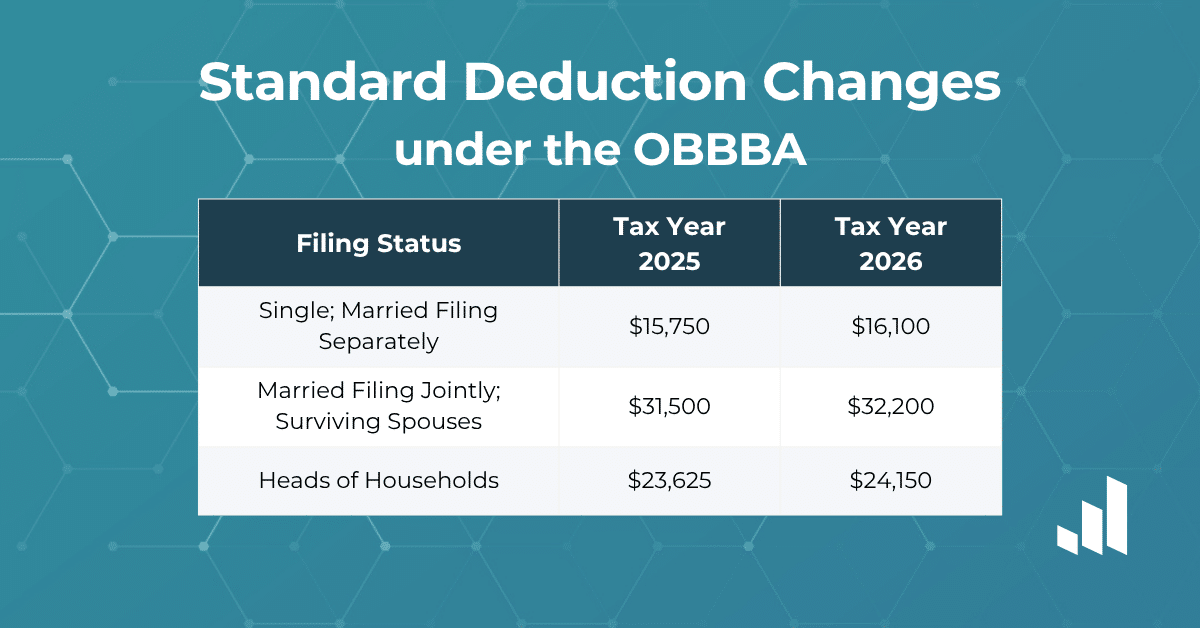

2026 Tax Brackets & Adjustments: What Changed

The IRS has released the 2026 tax brackets and inflation adjustments, reflecting significant changes under the One Big Beautiful Bill (OBBBA). From increased standard deductions to enhanced employer tax credits and estate exclusions, these updates will impact how individuals and businesses prepare for the 2026 tax year. Here's a breakdown of what changed—and what didn't.