Displaying: tax

Surgent course helps tax professionals conquer Inflation Reduction Act

Surgent’s first-to-market CPE course covers the IRA’s new tax provisions in detail, equipping participants to properly advise their individual and business clients if and how the tax changes impact their tax planning.

IRS tax training: 5 reasons to earn the AFSP – Record of Completion

Topic 606 and Construction Revenue: What CPAs Need to Know

In May 2014, FASB issued an Accounting Standards Update regarding Topic 606: Revenue from Contracts with Customers, along with various amendments, to be implemented in 2017 and 2019. In this post, we’ll talk about exact adoption dates of the new construction revenue recognition standards, the major updates, and how you can help your construction clients […]

Surgent Launches Futurecast™ Webinar Series with All-Star Lineup of National Tax and Accounting Experts

Surgent's new Futurecast premium monthly webinars deliver practical and timely insights from leading national experts in tax, accounting, auditing, and business management. Read why these just might become your favorite meeting of the month!

Intellectual Curiosity: It’s Admirable, but is it Deductible? Where to Draw the Line for Business Expenses

Can individuals deduct for business expenses associated with education outside of work? Read more for where the Tax Court drew the line in this case.

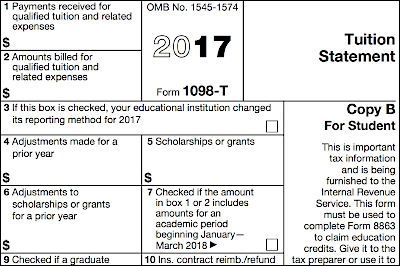

4 Common Errors to Watch for Regarding Form 1098-T

Eligible educational institutions often file Form 1098-T. Should you receive this form, here are four common errors to watch for, and how to interpret them.

Trump’s Vow to Abolish The Alternative Minimum Tax: Why This Could Mean More Cash Flow for Families

President-elect Donald Trump has proposed eliminating the Alternative Minimum Tax (AMT), a parallel tax that operates alongside the regular income tax. Abolishing this tax could mean more cash flow for families, the population often most often hit hardest with the AMT.

In Honor of National Tax Security Awareness Week, is Your Firm Taking Preventative Steps Against a Cyber Attack?

On the heels of tax filing season, this IRS effort aims to help consumers protect themselves and their financial data against identity theft and tax fraud. But what can firms do to protect consumers, and more importantly, their businesses?

Form 1095-C Deadlines for Reporting to Employees Extended Again This Year

In a surprising move, the Internal Revenue Service (IRS) issued Notice 2016-70 this week, extending the deadline for employers to furnish form 1095-C to employees and extending the good faith transition relief to the 2016 reporting year.