Though many of the details remain unclear, there's a general consensus that tax reform is on its way. Forbes' tax policy blogger, Tony Nitti, CPA, talks about why CPAs need to be prepared for any possible outcome, and why the time to start preparing is now.

Displaying: Tips & Resources

What Does it Mean to Have a Segregation of Duties?

As CPAs, we toss out the phrase segregation of duties quite a bit. But what does it mean? More importantly, do our clients understand what it means or why its important? Learn how to detect a segregation of duties by breaking a single transaction into 4 phases.

(Video) Why 2017 is Not the Year to Put Off Your Federal Tax Update Requirement

With the amount of tax updates coming down the pipeline this year, Forbes tax policy blogger Tony Nitti, CPA, shares on this video why 2017 is not the year to put off completing your Federal Tax Update CPE requirement.

10 Items to Consider As You Adopt the New Lease Accounting Standard

ASU No. 2016-02, Leases (Topic 842), the new lease accounting standard, is here. In this post, we highlight 10 items for consideration as you plan to adopt this standard.

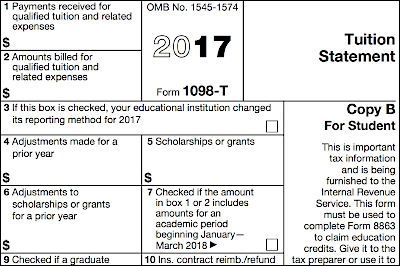

4 Common Errors to Watch for Regarding Form 1098-T

Eligible educational institutions often file Form 1098-T. Should you receive this form, here are four common errors to watch for, and how to interpret them.

2 Myths and 5 Tips For Middle Income Estate Planning*

Too often, middle income clients fail to seek the advice of a CPA because they’ve been taken in by two common myths. We know these are myths because every year, our estate planning discussion leaders present courses packed with practical tips and creative strategies that can be used for and with middle income clients. We’ve picked five of those tips to share with you.

Now is the Time to Brush Up on Your Knowledge of SSAE No. 18 and SSARs No. 23

With the effective date of both SSAE No. 18 and SSARS No. 23 just around the corner, now is the time to get up to speed on attestation engagements and the changes brought about by these new standards.

When Fraud Causes a Not-for-Profit to Close its Doors*

Charlie Blanton, CPA, expert in fraud and abuse in not-for-profit entities and governments, offers his advice for not-for-profits when it comes to fraud protection.

5 Tips for How to Prepare for an IRS Audit

No business owner wants to be faced with an IRS audit, and some may never have to, but if you receive a tax audit notice, be prepared with these 5 tips.

A Closer Look: FASB’s Amendments to Topic 606, Revenue From Contracts With Customers

With ASU No. 2016-20, Technical Corrections and Improvements to Topic 606, Revenue From Contracts With Customers, the FASB continued its response to implementation challenges and requests for clarifications received from the Transition Resource Group (TRG). The TRG, the group of practitioners, accountants and financial statement preparers tasked with vetting questions concerning Topic 606, Revenue from […]