Treasury recently identified eight regs to be rescinded or modified. The undertaking is quite an anomaly, akin to the scarcity of the unassisted triple play. Read more on the eight regulations in question.

Displaying: Tax

(Video) American Institute of Certified Tax Planners President Dominique Molina: Even Tax Geeks Get Creative

Surgent CPE instructor Dominique Molina, CPA, CTC says her love of numbers began at age 8, when she started balancing her parents' checkbook. Watch this video for why the co-founder and president of the American Institute of Certified Tax Planners is proud to be labeled a "tax geek," and says that even tax geeks can get creative!

Trump Administration’s Plan to Raise Standard Deduction Could Reduce Schedule A Filers by 80 Percent

If the Trump Administration's plan to raise the standard deduction becomes law, Surgent CPE estimates the number of Schedule A Filers will be reduced by 80 percent.

“A Better Way,” The Mnuchin Rule, and Anticipation of Trump’s April 26 Announcement

In anticipation of President’s Trump’s proclaimed “big tax reform and tax reduction” announcement on April 26, we take a closer look at the proposals of each of the key players in the Republican tax reform effort.

(Video) Tax Professionals Are the Target of This Phishing Scam – Don’t Become a Victim

We talked to Craig W. Smalley, EA, Founder & CEO of CWSEAPA, PLLC, a multi-state tax firm, about a phishing scam that's targeting tax professionals. CPAs, EAs, and tax preparers: find out how not to become a victim.

The Quick-and-Dirty Guide to The IRS Dirty Dozen

The IRS announced the latest "Dirty Dozen" scams. As this year’s tax season nears the finish line, keep in mind that taxpayers are subject to these scams year-round.

Intellectual Curiosity: It’s Admirable, but is it Deductible? Where to Draw the Line for Business Expenses

Can individuals deduct for business expenses associated with education outside of work? Read more for where the Tax Court drew the line in this case.

(Video) Need a Busy Season Break? A Joke from Comedian Greg Kyte, CPA

Take a quick break from busy season and hear stand-up comedian Greg Kyte, CPA share his latest joke.

2017: How Has it Differed from Other Years? Take the Busy Season Survey

With just about half of this year's busy season in the rearview mirror, it's time to pause and reflect. How has this busy season differed from other years? Take the CPA Trendlines Busy Season survey and tell us.

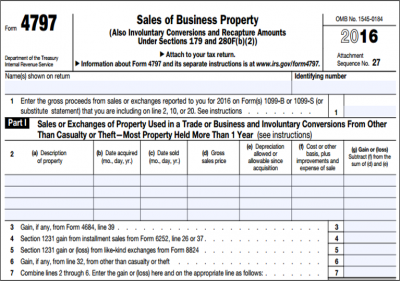

Form 4797 – Sale of Assets: The Good, The Bad and The Ugly

Form 4797 generally reports the sale of assets utilized in a trade or business as described in IRC §1231, but it can be tricky to complete without errors. We've broken down Form 4797 into what's good, what's difficult, and what can be an all-around headache.