Displaying: tax season

7 tips for success in continuing education

IRS filing relief for Schedules K-2 and K-3

Last year, the IRS announced new Schedules K-2 and K-3 for the 2021 tax year. These schedules were introduced to standardize the reporting of international tax items that were previously reported on Schedule K-1. The IRS published updated instructions for Forms 1065, 1120-S and 8865 on Jan. 18, 2022, stating that entities with no foreign […]

2017: How Has it Differed from Other Years? Take the Busy Season Survey

With just about half of this year's busy season in the rearview mirror, it's time to pause and reflect. How has this busy season differed from other years? Take the CPA Trendlines Busy Season survey and tell us.

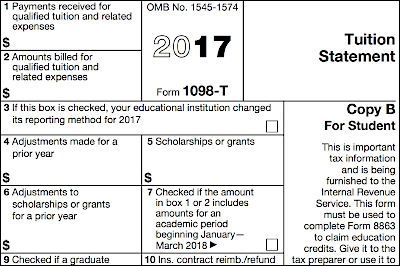

4 Common Errors to Watch for Regarding Form 1098-T

Eligible educational institutions often file Form 1098-T. Should you receive this form, here are four common errors to watch for, and how to interpret them.

2017 Tax Season Just Kicked Off: Here’s Your Playbook

As you prepare to file taxes for your clients and yourselves this tax season, we’ve highlighted the most important tax court decisions, tax law changes, and IRS rulings that will impact your filings.

Tax Season Recap – A Look Back At The 2016 Busy Season

Three calendar days later than usual, let’s take a few moments to consider a few of the high and low lights of the year as we say goodbye to busy season 2016.