Though we're on the brink of some sort of changes to the ACA, current guidance around healthcare reporting still stands. Here’s a quick rundown of what were we still need to comply for form 1095 and taxpayer self-reporting.

Displaying: Recent Posts

(Video) Hobby Loss: Above All Else, Is Your Client Really Trying to Make Money?

Peter J. Reilly, CPA, a 30-year veteran of accounting and a regular contributor for Forbes.com, discusses the complexities of hobby loss. Watch this video for a crash course in how to navigate this rule for your client.

Unsure When to Apply SAS No. 132? Understand the FASB and GASB Standards First

In February 2017, the AICPA issued SAS No. 132, The Auditor’s Consideration of an Entity’s Ability to Continue as a Going Concern, a key reason being that the AICPA needed to update the auditing literature for the accounting guidance found in FASB ASU No. 2014-15, which became effective at the end of 2016. To apply SAS No. 132 to an entity following the FASB or GASB standards, it is important to understand the accounting requirements found in those standards.

SSAE No. 18 Provides Clarity on Attestation Engagements: If You Think This New Standard Doesn’t Apply to Your Practice, Think Again

Statements for Attestation Engagements (SSAE) No. 18, Attestation Standards, Clarification and Recodification, will be effective for examination, review and agreed-upon reports dated on or after May 1. Now is the time to brush up on this new standard.

2017: How Has it Differed from Other Years? Take the Busy Season Survey

With just about half of this year's busy season in the rearview mirror, it's time to pause and reflect. How has this busy season differed from other years? Take the CPA Trendlines Busy Season survey and tell us.

House GOP Releases the Text of ACA Repeal and Replace Proposal

Late Monday, March 6, the full text of Congressional Republicans’ proposal to repeal and replace the Affordable Care Act was finally released. The bill, which has been given the title “The American Healthcare Act,” is now with the Congressional Budget Office (CBO) for “scoring” to determine its costs and impacts. Here's what we know now about key provisions and their timing.

FASB Issues Two New ASUs, Continuing its Early Torrid Pace in 2017

This past week, the FASB issued two new ASUs, bringing the total of Updates issued in the first two months of the year up to six, compared to two Updates issued by this time last year. Read more for an overview of each of these recent Updates.

Don’t Forget! 2017 is the First Year for New Earlier FBAR Filing Date

As a result of changes contained in the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015, the FBAR filing deadline has shifted forward to mid-April, effective in 2017. Read more for information on this new date and a new extension option.

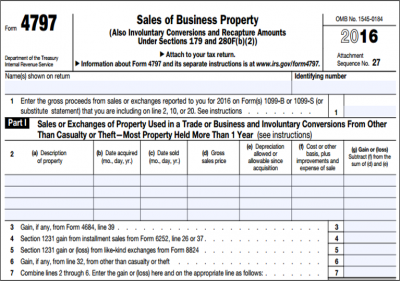

Form 4797 – Sale of Assets: The Good, The Bad and The Ugly

Form 4797 generally reports the sale of assets utilized in a trade or business as described in IRC §1231, but it can be tricky to complete without errors. We've broken down Form 4797 into what's good, what's difficult, and what can be an all-around headache.